Green Banking

- Bioenergy, Economics & finance, Energy efficiency, Hydrogen & PtX, Hydropower, Photovoltaics, Solar thermal, Wind energy

International Climate Initiative with support of the German Federal Ministry for the Environment, Nature Conservation and Nuclear Safety (BMU)

Academic services, Business matchmaking, Capacity needs assessment, Communication services, Customer-specific programmes, Development of curricula and training material, Quality assurance, Study & delegation tours, Train-the-trainer programmes

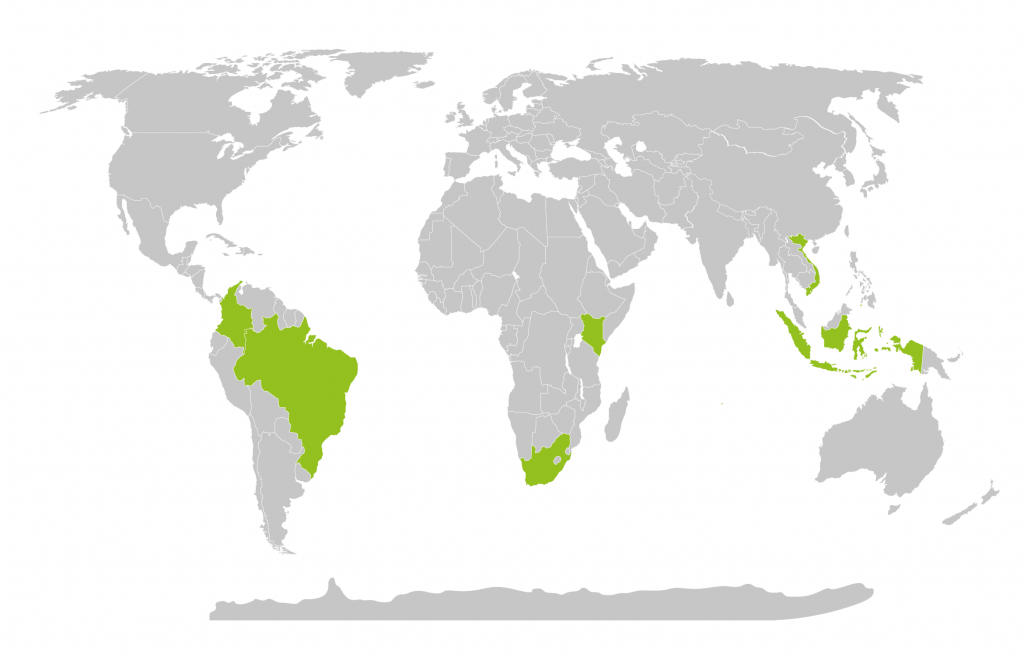

Brazil, Colombia, South Africa, Kenya, Indonesia and Vietnam

2024 - 2026

What Is The Project About?

The Green Banking project aims to support target groups in the development and implementation of green energy and climate finance throughout the entire banking value chain. Through the holistic trainings offered, professionals from the banking sector, project developers and policy makers will gain knowledge on financing renewable energy and energy efficiency projects.

To date, two project phases have been successfully implemented in Southeast Asia and Latin America. The 3rd phase of the project will run from 2024 to 2027.

What are The Objectives?

The Green Banking project’s main goal is to enhance the skills and capabilities of personnel and institutions in the implementing partner countries for financing Renewable Energy (RE), Energy Efficiency (EE), hydrogen, and storage projects. It also aims to establish sustainable capacity building programmes programs for banks, investors, and project developers in the partner countries.

The project has two priorities:

- Transfer knowledge on the technical and economic fundamentals of RE, EE, hydrogen, and storage projects, along with their economic assessment, to increase investment and financing from development banks, commercial banks, private equity, venture capital, infrastructure funds, and institutional investors.

- Transfer knowledge and facilitate networking on accessing German and international climate change financing instruments, such as the Green Climate Fund, to enhance local financing opportunities for RE and EE by integrating international financing sources.

Call for Applications:

Green Banking Expert Database

Who Can Participate?

This project aims to benefit the financial sector, as well as private and public sector stakeholders, by providing targeted training programs.

Financial Sector:

- Development banks

- Commercial banks

- Private equity and venture capital firms

- Infrastructure funds and other institutional investors

Private Sector:

- Project developers involved in RE projects and EE measures, including engineering firms, service providers, and energy consultants.

- Corporate companies and SMEs with potential for RE investments or EE measures.

Public Sector and Multiplicators:

- Representatives from ministries and authorities involved in RE project regulations and EE measures

- Representatives from RE associations, EE networks, and NGOs promoting green energy projects

What does Green Banking Offer?

Participants will gain specific know-how in renewable energy and energy efficiency technologies, as well as appropriate risk evaluation and mitigation schemes. The development of private sector finance instruments for climate change mitigation will be fostered and the readiness to leverage national credit lines with international climate change mitigation schemes will be increased. Knowledge about existing international climate change mitigation funds and the available access opportunities will be disseminated.

Green Banking provides scholarships for:

Launch Events:

- Official launch of the Green Banking project in partner countries

- B2B meetings with key stakeholders and public partners

- Duration: 3 days

Online Training on Green Hydrogen Projects:

- Introduction to green finance

- Duration: 3 months

Online Training on “Applying Green Energy Finance”:

- Two training tracks for Project Developers & Small-scale Projects

- Duration: 3 months

Blended Training “Green Energy Finance Specialist”:

- In-depth knowledge on green energy and climate finance topics

- After successful participation in Online Training participants qualify for the country-specific In-person Seminar

- Duration: 5-month Online Training and 3-day In-person Seminars in the partner countries

Train-the-Trainer seminars:

- For professionals with experience in green energy finance willing to contribute to the “Green Finance Specialist” seminars

- Duration: 5 days in partner countries

Delegation Tour and B2B meetings:

- Networking with RE and EE financing experts in Germany

- B2B meetings with financial institutions

- Duration: 5 days in Germany

Application

Applications for the various activities within Green Banking will open in the second half of 2024.

Past Projects

The IKI Independent complaint Mechanism is intended to enable people who suffer (potential) negative social and/or environmental consequences from IKI projects, or who wish to report the improper use of funds, to voice their complaints and seek redress. It follows established international standards for International Accountability Mechanisms.

You can find more information on the IKI complaint Mechanism on the dedicated website here: https://www.international-climate-initiative.com/en/about-iki/values-responsibility/independent-complaint-mechanism/.

Interested in RENAC trainings?

Type of training:

Next Date:

Duration:

Fee:

Type of training:

Next Date:

Duration:

Fee:

Type of training:

Next Date:

Duration:

Fee:

Type of training:

Next Date:

Duration:

Fee:

Type of training:

Next Date:

Duration:

Fee:

Type of training:

Next Date:

Duration:

Fee:

Type of training:

Next Date:

Duration:

Fee:

Type of training:

Next Date:

Duration:

Fee:

Type of training:

Next Date:

Duration:

Fee:

Type of training:

Next Date:

Duration:

Fee:

Type of training:

Next Date:

Duration:

Fee:

Type of training:

Next Date:

Duration:

Fee:

Type of training:

Next Date:

Duration:

Fee:

Type of training:

Next Date:

Duration:

Fee: